Back to the thread topic, I see the UK MPs' Treasury Committee is recommending that crypto be regulated as a form of gambling rather than investing:

https://www.theguardian.com/technol...ould-be-regulated-as-form-of-gambling-say-mps

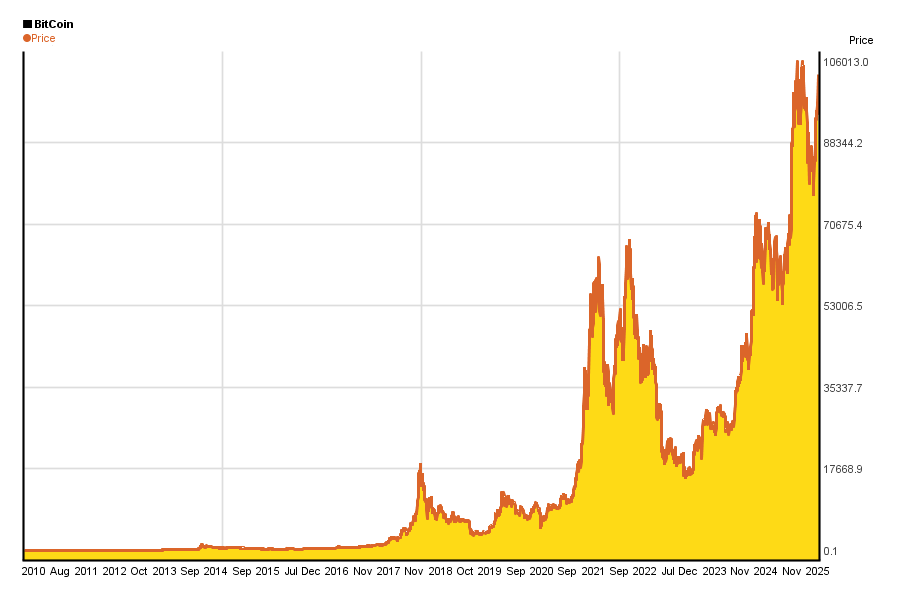

The argument is that it is a form of speculation that can become addictive, in unbacked assets, whereby investors can lose life-changing sums.

Separately, there was a report in yesterday's FT on the US DoJ cracking down on cryto platforms, to reduce money laundering and other funding of criminality. The article mentions not only FTX and Sam Bankrun-Fraud but also the taking down of Bitzlato in January and the current DoJ focus on Binance. Apparently some in the industry are expressing concerns that destabilising Binance could have large effects on the crypto industry. The DoJ reaction, apparently, is to say that they will absolutely not be taking such concerns into account, as criminality is criminality.

So it looks as if the regulators and lawmakers are waking up, at last.