The worst selloff in emerging-market currencies in five years is beginning to reveal the extent of the fallout from the Federal Reserve’s tapering of monetary stimulus, compounded by political and financial instability.

The Turkish lira plunged to a record and South Africa’s rand fell yesterday to a level weaker than 11 per dollar for the first time since 2008. Argentine policy makers devalued the peso by reducing support in the foreign-exchange market, allowing the currency to drop the most in 12 years to an unprecedented low.

Investors are losing confidence in some of the biggest developing nations, ... “The current environment is potentially very toxic for emerging markets,” Eamon Aghdasi, a strategist at Societe Generale SA ... “You have two very troubling things: uncertainty about the Fed policy, combined with concerns about growth, particularly in China."

The declines were part of a broader slide in global markets today, with stocks in Asia, Europe and the U.S. tumbling. Yields on 10-year German bunds slipped to an 11-week low,

while the yen, considered by investors as a haven, rose versus all 16 major counterparts tracked by Bloomberg.

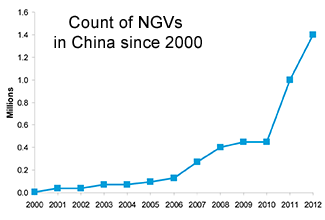

Billy T inserts this graph to show that the price of

gold, the historic safe haven, rose at more than a $2/day rate for last 30 days!

Big Banks are telling YOU to sell gold. "Its going below $1100/ oz," but are accumulating tons for their own accounts!

Currencies of commodity-exporting countries that depend on Chinese demand sank, with the rand plunging 0.9 percent, following yesterday’s 1.1 percent decline. Brazil’s real fell 0.1 percent while Chile’s peso sank 0.3 percent after decreasing 1.2 percent yesterday. Argentina’s peso fell 12 percent yesterday, marking its biggest decline since a devaluation in 2002. It sank an additional 1.5 percent today to 8.0014 per dollar. ... The peso traded at around 13 per dollar in the black market yesterday.

The Turkish central bank’s first unscheduled intervention in more than two years wasn’t enough to stop the lira from setting a record low today. Investors are speculating the central bank’s efforts to prop up the lira by burning through foreign-exchange reserves will prove futile without raising interest rates. Turkey’s central bank refrained from raising benchmark rates this week, fueling concern that it will be difficult to finance current-account deficits. The lira plunged to a record 2.336 per dollar and also declined to an all-time intraday low of 3.2069 per euro. Turkey holds about $33 billion in foreign reserves, excluding deposits from commercial banks, only enough to cover 1 1/2 months of imports, according to Citigroup Inc.

“It’s a bad storm,” Neil Azous, the founder of Rareview Macro LLC, a Stamford, Connecticut-based advisory and research firm, said. “Their net foreign-exchange reserves are dwindling pretty fast. They’re definitely in the danger zone.

China is struggling to contain $4.8 trillion in shadow-banking debt, raising concern about the growth outlook for a country that buys everything from Chile’s copper to Brazil’s iron ore. A corruption investigation is embroiling Turkish Prime Minister Recep Tayyip Erdogan’s cabinet, while deadly protests in Ukraine and Thailand are eroding confidence in the political stability of developing nations. {Billy T inserts: Not to mention approval of US congress recently was only 13% - an all time low.}

Ukraine’s hryvnia has slumped as Parliament planned to hold an emergency session after anti-government protests led to fatalities this week. The currency fell as low as 8.48 per dollar, the weakest since 2009, before reversing losses to gain 0.1 to 8.435 per dollar. South Africa’s rand tumbled as much as 1.8 percent to 11.1949 per dollar today on concern a strike at the world’s biggest platinum mines would dent the country’s exports. ... “In an environment of rising U.S. rates, the market is quickly finding out who has been swimming naked,” Dirk Willer, a Latin America strategist at Citigroup, the second-largest currency trader, wrote in a client note. ...