We agree that there is no fund making investments in either SS or Ponzi's schemes so none of your above is a difference between SS and a Ponzi scheme.

The difference is that SS doesn't gain its contributions by decieving people about where the money is going. Nor do its administrators take a profit out of the incomes.

One could argue that SS also invests as it gets interest on the contributor's money it gives to the government to spend now; however, (and especially now with low interest rates on US bonds) the real rate of return is negative.

That's not true. In the first place, the current rate on the bonds doesn't matter because SS isn't currently producing a surplus to invest in such things. In the second place, at no time has the bond yield been below inflation - the returns have always been positive in real terms.

The SS administartion should not be allowed to call your SS tax "Your SS contribution to your Social Security."

It is a contribution to "

your social security." Keeping all of those retirees housed and fed makes

your society

more secure. Most of us have retired parents that we'd be housing and feeding if not for SS - that makes my social position more secure, right now, because of my current payments.

We both agree it is really a social welfare system and also I note a very useful means of transfer from the rich to the poor (on average)

No, Social Security is a flat, capped payroll tax. It is among the most regressive portions of the tax code. People with very high incomes pay a much lower rate than those with low incomes, and people with incomes derived primarily from sources other than a payroll (which includes a big chunk of the very wealthy) pay very little towards SS at all.

It's been credibly suggested that payroll taxes are so regressive in structure that they cancel out the progressive structure of the income tax.

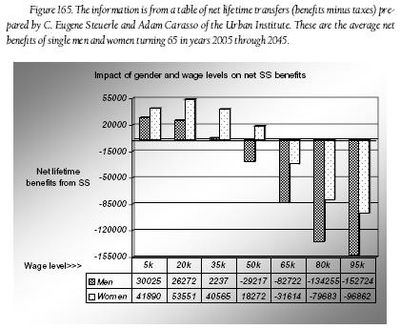

-Probably why a target for right winger attacks. See how effectively it transfers funds in bar chart below:

That chart is almost meaningless. The one you want to look at is the one for benefits to married couples, which are uniformly positive. Since almost everyone gets married, that's the relevant one, not the one showing what would happen to hypothetical individuals who never married. If you want to view it in those terms, SS is a scheme to transfer funds from single people to married couples.

Also note that your chart tops out at the 95k income range, which is right where the cap starts. I.e., it excludes the regressive effects on those with high incomes entirely.

I just don't like the government presenting SS to the public in such a way that most think of its tax as part of their investment for their old age. ("YOUR social security")

I don't see where the government does that, absent some very selective reading on your part. In the first place, paying for current retirees does increase one's social security, essentially by definition. And in the second place, supporting the social security system, both financially and politically, means that such a system will be available when you retire (if not your actual contributions from years ago). And so, again, it increases

your personal social security.

the SS system will be modified so that almost everyone now contributing (on average) get a very negative net return

If you object to viewing Social Security as an investment fund, then why do you keep treating Social Security as if it were an investment fund? I.e., calculating "net return on investment" in terms of monetary pay-outs, and insisting that this is the salient feature of the system.

The return on your investment is that you live in a society where people don't have to worry about housing and feeding their retired parents, in addition to their own kids. And that return is strongly positive, regardless of precisely how much you personally get paid during your retirement.

I agree here too. The right wingers would not be able to do this IF the government were honest and ceased to call SS "your social security."

Is the presence of the word "your" the only basis for your insistence that the government is misleading the public? Because that's pretty weak - from where I sit, it's the insistence on your (and others') part on viewing Social Security in terms of an investment fund, while totally neglecting the actual purpose and benefits of the program from your accounting, that looks like the misleading stuff.

because the US population is aging.

It has to be aging faster than productivity is growing for that to imply a structural shortfall in SS. And I see no prospect of, nor grounds for, the government to throw up its arms and declare that our productivity will never keep up with our aging, for decades into the future. We could change the immigration policy tomorrow and basically halt the aging of the workforce, for one thing. The policies that affect these factors in the long run are not etched in stone, to be extended arbitrarily far into the future, and the government should not use Social Security literature to pretend otherwise.

Fortunately the rich and powerful tend to be ignorant of how effective a wealth transfer system SS is. If they understood, SS would soon be abolished.

The rich and powerful don't care - they don't get much income from payrolls in the first place, and it's a flat, capped tax anyway, so it's not their money being "transferred," mostly. Again, they don't even appear on your charts.