Don't miss the three photos supporting my point at the end of this post and one at start of prior post.

But they don't yet have the political might, and without that it ain't gonna happen. … China will certainly become the world's largest economy in the next decade or two, but economic might isn't very effective without political might, and they ain't got it.

Not yet, but political power flows from economic power. (No longer from the "barrel of a gun" in the nuclear bomb /ICBM "mutual stand off" age.)*

Much of China's economy is based on manufacturing products for the U.S. market. Over the last couple of decades, Mexico has quietly turned itself into a middle-class country with the resources to take over that manufacturing function. The U.S. will happily switch production from China to Mexico for a number of reasons ...

Yes and China is very happy about that too, tired of selling to US and UE who need loans to buy with. China's stated goal is to switch from an export based economy to a domestic one. This is why the salaries are growing by double digits in purchasing power. Why the CCP has made the out of pocket medical cost only 1/3 of paying the total cost (instead of 2/3 as it was a few years ago), Why China is building the world's largest network of modern rails for world's highest speed trains - reducing time loss and transportation costs while making many new job through out the country, built the world largest hydro-electric and flood control project and is now completing by far the world's most massive water transfer project:

http://www1.american.edu/ted/ICE/north-china.html said:

Chinese government has proposed and is in the midst of a massive construction project called the South-North Water Transfer (or Diversion) project (SNWT). This $62 billion project aims to divert water from the rain-plentiful south to the water-limited north via three routes, the East, Central and West. By 2050, 44.8 billion cubic meters will go from the south to the north a year. Basins in northern China will see their water supply increase by 34.5% as a result of the SNWT ... {See photo of small part at end of post and comparison to the annual Nile river flow}

Chinese were saving more than 50% of their disposable income until recently mainly to be able to pay for their and their parents medical cost in old age. Unfortunately, for the CCP, they still do save nearly at the same rate as long established habits die slowly. Now with the one child policy in place for a few decades, they are saving in part to help their heirs get a house. There can be up to eight grand parents and four parents for the young couple wanting to get married all of whom are happy to lend money for their buying of a house.

Urban Chinese girls will not say “yes” to a marriage offer unless the groom to be has a home for them, which he typically buys with loans from his and her living ancestors. I. e. most new urban homes sold in China are paid up front in cash with no mortgage! Very frustrating for the CCP which wants the Chinese to be more like Americans and live beyond their means by borrowing from banks and using credit cards etc. Most, (>90%), of Chinese don't even know what a credit card is! They don't pay hardly any interest into the economy (banks and credit card companies – that is often the American's major expense, except for food in some cases.) Chinese are like Americans of the 1900s – they save up to buy rather than borrow.

The CCP has had much more success with reducing it needs to sell to the US. In 2002, 42.4% of China's exports went to the US and in 2011 (latest data available at

http://www.census.gov/foreign-trade/balance/c5700.html ) only 16.2% did. So 10 years ago the US was 42.4 /16.2 = 2.6 times more important to China than it is now. When China gets that down to 10% or less of its exports, it is to China's economic advantage to kill the dollar, assuming that domestic growth and exports to others, who don't need loans to buy with, can keep Chinese factories running at near capacity. Exports to others are very rapidly growing now. Many countries now, including S. Korean, Japan, Brazil, India, Russia and almost all Asian countries and many, if not most in South and Central America, have China as their main trading partner or at least a very close second. Not only that but China has dozens of “currency swap” agreements so even settling trade imbalances do not use dollars any more. Also several oil producers don't require dollars in payment for their oil – the “petrodollar” system is dying.

China has been for several years reducing the fraction of its reserves in dollars, in part by buying gold but more by paying up front in long term (up to 30 years) delivery contract for the energy and material imports it will need in the future. For example, nearly five years ago, China gave PetroBras 10 billion dollars for 200,000 barrels of oil (daily average) delivered for 20 years. I. e. soon it will be to China's economic advantage to take a ONE TIME loss on the dollar assets still in its reserves for the EVERY YEAR lower cost of imports with deep in debt US and EU in a collapsed dollar depression.

But the main reason why the RMB will replace the dollar as the world's reserve currency is that when ready, China will back its RMB bonds with gold for central banks and the IMF if the dollar has not already collapsed. – That may happen first as now that interest rates are rapidly rising, rolling maturing debt is growing ever more costly and the US still goes deeper into debt each year.

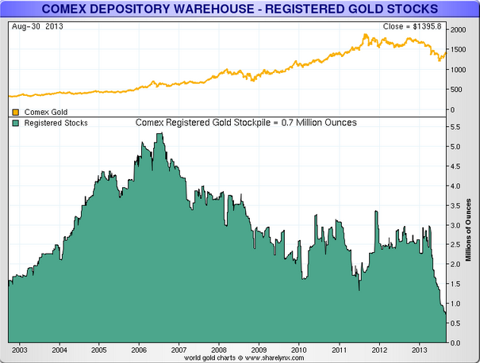

China is the world's largest producer of gold, but never sell even an ounce. China is now also the world's largest buyer of gold, buying more than all the mines outside of China can produce. At the present rate of Chinese buying they will buy more than 1000 metric tons in 2013 – more than twice what they bought in 2012.

China wants to pay for its imports with printed paper as US has done for more than 30 years. To do that they need “reserve currency” status. If you don't think China is planning to back the RMB with gold, then is why China is buying so much gold and producing more than the second place producer by 40 or more percent; why are they doing that?

Central banks will certainly prefer gold backed RMB bonds to un-backed dollar bonds, especially if they pay more interest than the US bonds do, which wealthy China can easily afford to do. There is a lot of gold, so we are told, at Fort Knox, but if it is there and it is US owned, why can Germany only gets its gold back from the US after a seven year wait? The last physical audit of the gold at Fort Knox was partial, done by Fort Knox people, not by independent auditors, and took place in 1950 – 63 year ago! I think Ron Paul had good reason to want a new independent audit.

As I said earlier: “Political power flows from economic power.” That is what China is rapidly gaining and what the US is losing. Empires have a historical habit of falling, with surprising speed and being replaced, I sure you, with your interest in history, know. Fact that in first half of 2013, 77% of all new US jobs created were part-time, low wage jobs does not speak well for an economy based 2/3 on Joe American's consumption.

* In his old age, Alford Nobel was asked if he did not regret putting sticks of dynamite in the hands of crooks, bank robbers, etc. His reply was, (freely translated): "My only regret is that dynamite is not powerful enough to end war." The A & H bombs have done that for larger powers like China and the US. Their struggle for world domination is via economic power now.

This energy efficient train goes faster than all prop-type, air planes > 500Km /hour.

For scale, note the large earth mover at edge, bottom center.

Eastern and central parts will be operational in 2014 after more than a decade of intense construction and testing. The Nile flow is just over 80 cubic kilometers per year. (reference at:

http://www.google.com/#fp=b1848aaff8811878&q=annual+flow+of+nile+river) and a cubic Km is 1000^3 cubic meters, or Nile moves 80 billion cubic meters vs. China is moving 44.8 billion cubic meters. I.e. the Nile moves less than twice as much water as China will but the Nile moves its water slightly more than twice a far. No other man-made water project come even close (not even within 3%) to what China has done to improve the economic health of the nation as world moves into the era of water shortages! China's "half Nile" does a trick nature's Nile can't do: It delivers water to the Beijing area 45 meters higher than its source! (2.8 billion kWh/year pumping energy) China started funding studies for this world's largest water project in 1950!

Lake Powell and Lake Mead supply much of the water needed by S. W. USA and they are going dry:

The US does not have an organizational structure to solve its largest water problem, with Congress mainly interested in the next election and not funding multi-decade-long water projects with first benefits long after they have left office. With cost of ~10% of China's 62 billion dollars, US could transfer water from the Great Lakes, mainly via existing rivers, to save the South West from disaster, but that will not be done by Congress.

Scripps Institution of Oceanography / University of California, San Diego says: "... There is a 50 percent chance Lake Mead, a key source of water for millions of people in the southwestern United States, will be dry by 2021 if climate changes as expected and future water usage is not curtailed, ... Without Lake Mead and neighboring Lake Powell, the Colorado River system has no buffer to sustain the population of the Southwest through an unusually dry year, or worse, a sustained drought. In such an event, water deliveries would become highly unstable and variable, ..." From:

http://scrippsnews.ucsd.edu/Releases/?releaseID=876

SUMMARY: Yes, economic power and ability to use it via multi-decade planning** leds to political power and ability to dominate the world.

** China has 10 "five-year" plans, each becoming precisely detailed and adjusted as they come closer to the present. The central committee of the CCP is elected for 10 year terms and often serves several. Its members mainly have advanced engineering degrees, although a couple are economists and geologists. Unlike the US Congress and administration, where >90% were educated as lawyers, there is not a single lawyer high up in the CCP!